Disability insurance is a crucial component of financial planning, offering income protection in the event that illness or injury prevents a person from working. In Canada, disability insurance is designed to ensure financial stability by replacing a portion of lost income, alleviating the financial stress of living with a disability. As one of the most important forms of insurance, disability coverage plays a vital role in safeguarding individuals, families, and businesses.

This article explores the various disability insurance plans available in Canada, the types of coverage they offer, eligibility criteria, and their importance to Canadians. We will also examine public and private disability insurance options, the impact of disability insurance on individuals and society, and common considerations when choosing a plan.

1. Overview of Disability Insurance in Canada

Disability insurance is designed to provide financial support if someone cannot work due to illness, injury, or a long-term health condition. Coverage can replace up to 60-85% of lost income, depending on the policy, and provides a critical safety net for individuals facing unexpected health challenges.

a. The Importance of Disability Insurance

Disability insurance is essential because the risk of becoming disabled is higher than most people realize. According to the Canadian Life and Health Insurance Association (CLHIA), one in three working Canadians will experience a period of disability lasting longer than 90 days before age 65. Disabilities can result from physical injuries, chronic illnesses, or mental health conditions, and the loss of income can significantly impact one’s quality of life.

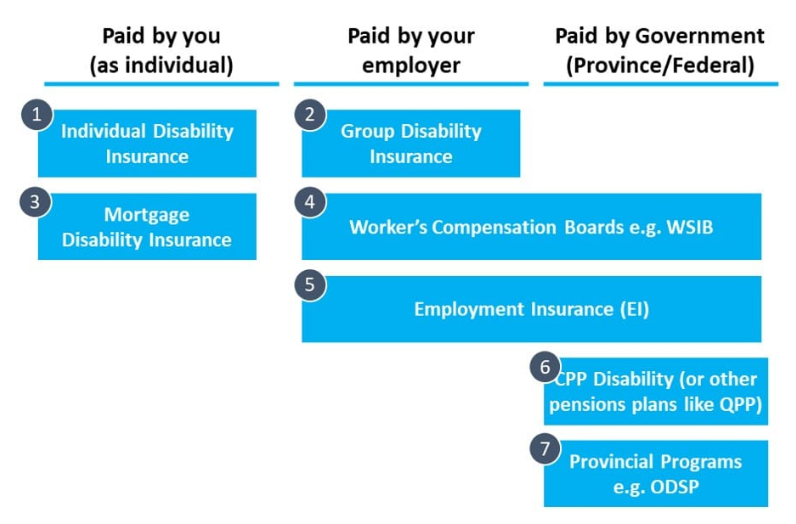

b. Public vs. Private Disability Insurance

In Canada, disability insurance coverage comes from both public programs, such as the Canada Pension Plan (CPP) Disability Benefits, and private insurance providers. Public disability insurance provides a basic level of income replacement, while private plans offer a range of additional coverage options to fill the gaps in public programs. Many Canadians rely on a combination of both sources to ensure sufficient financial security during a period of disability.

2. Types of Disability Insurance Plans Available in Canada

a. Short-Term Disability Insurance (STD)

Short-term disability (STD) insurance provides income replacement for temporary disabilities lasting from a few days to several months. STD plans typically offer coverage for up to six months, although some policies may extend benefits for up to a year. These plans cover short-term health issues, such as injuries, surgeries, or illnesses requiring a temporary leave from work.

- Coverage Percentage: Typically, STD insurance covers between 60-85% of a person’s income, depending on the plan.

- Elimination Period: STD policies usually have a waiting period (often referred to as an elimination period) of between one and 14 days after the disability onset before benefits begin.

- Common Sources: Many employers provide STD insurance as part of group benefits packages. However, individuals can also purchase private short-term disability coverage if their employer does not offer it.

b. Long-Term Disability Insurance (LTD)

Long-term disability (LTD) insurance provides income replacement for extended periods, covering serious illnesses or injuries that prevent someone from working for months or even years. LTD coverage is essential for more severe and prolonged disabilities, such as chronic health conditions, major surgeries, or injuries requiring extensive recovery time.

- Coverage Duration: LTD insurance can cover individuals until they reach the age of 65, depending on the policy terms. Coverage typically starts after the short-term disability benefits expire.

- Income Replacement: Like STD, LTD insurance generally replaces 60-85% of the policyholder’s income, although specific amounts depend on the policy details.

- Own Occupation vs. Any Occupation: Some LTD policies only provide benefits if the individual cannot perform their own occupation (own occupation coverage), while others only provide benefits if they cannot work in any occupation (any occupation coverage). Own occupation policies tend to be more expensive but offer greater flexibility for individuals returning to a different role.

c. Critical Illness Insurance

While not strictly a form of disability insurance, critical illness insurance provides a lump-sum payment if the policyholder is diagnosed with a severe illness, such as cancer, heart disease, or stroke. This coverage helps offset the costs associated with critical illnesses, such as medical bills, home modifications, or hiring in-home care.

- Use of Benefits: Policyholders can use the payout for any purpose, which adds financial flexibility during difficult times. Some people may use it to cover lost income, while others may use it to pay for treatments not covered by provincial healthcare.

- Complementary Coverage: Critical illness insurance can complement disability insurance, as the lump-sum payment provides immediate financial support, while disability insurance offers ongoing income replacement.

3. Public Disability Insurance Programs in Canada

a. Canada Pension Plan (CPP) Disability Benefits

The CPP Disability Benefit is the main public disability program in Canada, administered by the federal government. It is designed to provide financial assistance to Canadians who have made sufficient contributions to the CPP and are unable to work due to a severe and prolonged disability.

- Eligibility Requirements: To qualify, applicants must have contributed to the CPP for at least four of the past six years and meet the criteria for a severe and prolonged disability.

- Benefit Amount: CPP Disability Benefits are based on the applicant’s CPP contribution history and include a fixed base amount plus a percentage of the average earnings while contributing to CPP.

- Additional Support for Children: Children of CPP Disability Benefit recipients may also be eligible for a children’s benefit if they are under the age of 18 or between the ages of 18 and 25 and attending school full-time.

b. Employment Insurance (EI) Sickness Benefits

EI Sickness Benefits provide temporary financial support for Canadians unable to work due to illness, injury, or quarantine. Unlike CPP Disability Benefits, which are meant for long-term disabilities, EI Sickness Benefits offer short-term income replacement.

- Duration and Coverage: EI Sickness Benefits cover up to 55% of the recipient’s average weekly earnings, with a maximum duration of 15 weeks.

- Eligibility: To qualify, individuals must have accumulated at least 600 insurable hours in the previous 52 weeks and provide a medical certificate confirming their inability to work.

c. Provincial and Territorial Programs

In addition to federal programs, some provinces and territories in Canada offer their own disability support programs. These programs vary significantly in terms of benefits, eligibility criteria, and duration. Examples include Ontario’s Disability Support Program (ODSP), British Columbia’s Disability Assistance, and Quebec’s Social Assistance Program.

4. Private Disability Insurance Plans

a. Employer-Sponsored Group Disability Plans

Many Canadian employers provide group disability insurance as part of their employee benefits packages. These plans often include both STD and LTD coverage, and premiums are typically shared between the employer and employee. Group plans generally offer coverage at a lower cost than individual policies.

- Tax Implications: In most cases, if the employer pays for the disability insurance premiums, the benefits are taxable to the employee. Conversely, if the employee pays for the premiums, the benefits are non-taxable.

- Supplemental Coverage: Some employers offer supplemental disability insurance options, allowing employees to increase their coverage amount or extend the duration of their LTD benefits.

b. Individual Disability Insurance

Individual disability insurance policies are available for those who are self-employed, do not have access to employer-sponsored plans, or wish to supplement their group coverage. These policies provide more flexibility in terms of coverage amounts, duration, and additional benefits.

- Benefits of Customization: Individual policies offer greater customization than group plans, allowing policyholders to select coverage tailored to their unique needs.

- Self-Employment: Individual disability insurance is particularly important for self-employed individuals, as they cannot rely on employer-sponsored benefits in case of disability.

c. Mortgage and Credit Disability Insurance

Mortgage and credit disability insurance are specialized policies that cover debt payments if the policyholder becomes disabled and cannot work. Mortgage disability insurance covers mortgage payments, while credit disability insurance covers payments on loans, credit cards, and other debt obligations.

- Policy Coverage: These policies typically only cover the debt amount, which may limit flexibility in managing broader financial needs.

- Advantages: Mortgage and credit disability insurance provide targeted protection, ensuring that important debt payments are covered during periods of disability.

5. Key Considerations When Choosing a Disability Insurance Plan

a. Coverage Amount and Duration

When choosing a disability insurance plan, it’s essential to assess how much income replacement is needed and for how long. Some individuals may only require short-term coverage, while others may need a plan that provides benefits until retirement age.

b. Definition of Disability

Different plans define disability in different ways. Understanding whether a policy covers “own occupation” or “any occupation” is crucial, as it affects eligibility for benefits. “Own occupation” coverage provides more flexibility but may be more expensive.

c. Waiting Period and Elimination Period

The elimination period is the time between when the disability occurs and when the benefits begin. Shorter elimination periods offer faster access to benefits but generally come with higher premiums.

d. Premium Costs and Tax Implications

Premium costs vary based on the type of plan, coverage amount, waiting period, and other factors. Additionally, the tax treatment of disability benefits depends on who pays the premiums, so it’s essential to understand these implications when budgeting for a policy.

6. The Role of Disability Insurance in Canadian Society

a. Promoting Economic Security

Disability insurance plays a critical role in promoting economic security, protecting individuals and families from financial hardship in times of need. By offering income replacement, disability insurance helps individuals maintain their standard of living and contributes to overall economic stability.

b. Supporting the Workforce

Disability insurance enables people to return to work gradually after an illness or injury, supporting workforce participation and reducing the financial burden on public assistance programs. Programs like “own occupation” coverage encourage a smooth transition back into the workforce, preserving talent and experience within the labor market.

c. Enhancing Quality of Life

By reducing financial stress, disability insurance enables individuals to focus on their recovery, access necessary medical treatments, and adapt to lifestyle changes without the additional burden of income loss.

Conclusion

Disability insurance is a critical component of financial planning and an invaluable safety net for Canadians facing unforeseen health challenges. With a range of public and private options available, Canadians can access various disability insurance plans to suit their unique needs. Whether through employer-sponsored plans, individual policies, or public programs, disability insurance offers essential financial protection, promotes economic resilience, and enhances overall well-being. As Canadians navigate the uncertainties of health and employment, disability insurance remains a cornerstone of personal and societal security.